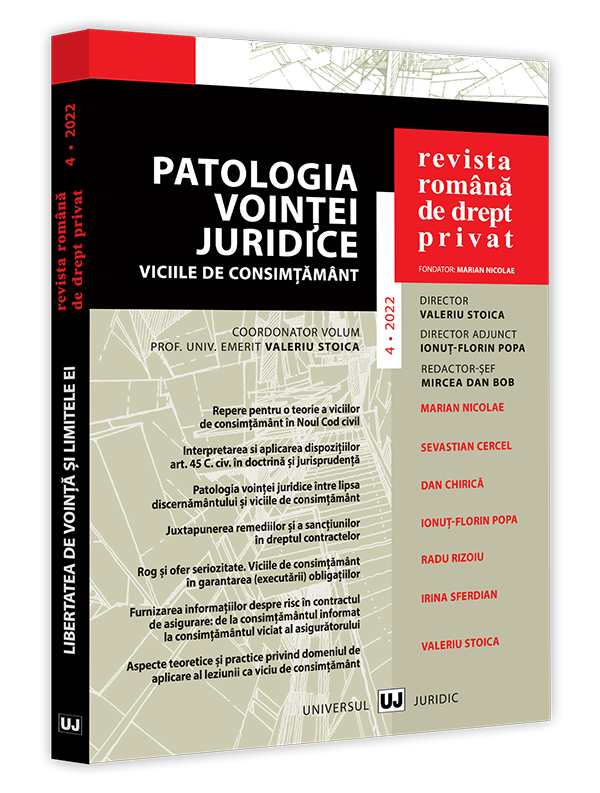

PROVISION OF RISK INFORMATION IN THE INSURANCE CONTRACT: FROM INFORMED CONSENT TO VITIATED CONSENT OF THE INSURER

Abstract

The formation of the insurance contract is a complex process in which a key role is played by the insured’s obligation to provide the insurer with full information about the risk the insurer will assume. The insured’s provision of detailed and honest information about the risk may be prompted by clear and precise questions from the insurer, but the law also obliges the insured to make a spontaneous declaration. At the pre contractual stage, the insurer is in a vulnerable position, which may lead to a vitiated consent at the time of conclusion of the contract. This is why the insurance contract belongs to the category of maximum good faith contracts. A false statement, whether intentional or not, on the part of the insured person has a direct impact on the insurer and, indirectly, on all policyholders who are members of the same insurance fund.

Published

Versions

- 2023-04-11 (2)

- 2023-02-26 (1)